Medigap is a term for a health insurance policy sold by private insurance companies to fill the "gaps" in original Medicare Plan coverage. Medigap policies help pay some of the healthcare costs that the original Medicare Plan doesn't cover. Medigap policies are regulated under federal and state laws and are "standardized." There may be up to 12 different standardized Medigap policies . Each plan, A through L, has a different set of basic and extra benefits. The benefits in any Medigap Plan A through L are the same for any insurance company. Each insurance company decides which Medigap policies it wants to sell.

Most of the Medigap claims are submitted electronically directly from the Medicare intermediary to the member's BCBS Plan via Medicare Crossover process. Medigap does not include Medicare Advantage products, which are a separate program under the Centers for Medicare & Medicaid Services . Members who have a Medicare Advantage Plan do not typically have a Medigap policy because under Medicare Advantage these policies do not pay any deductibles, copayments or other cost-sharing. Occasionally, you may see identification cards from members of International Licensees or that are for international-based products. Currently, those Licensees include Blue Cross Blue Shield of the U.S.

ID cards from these Licensees and for these products will also contain three-character prefixes and may or may not have one of the benefit product logos referenced in the following sections. See below for sample ID cards for international members and products. If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company . Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers. BlueCard is a national program that enables members of one BCBS Plan to obtain health care services while traveling or living in another Blue Cross and Blue Shield Plan's service area. A Medicare Advantage PPO is a plan that has a network of providers, but unlike traditional HMO products, it allows members who enroll access to services provided outside the contracted network of providers.

Required member cost-sharing may be greater when covered services are obtained out-of-network. Medicare Advantage PPO plans may be offered on a local or regional (frequently multi-state) basis. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network.

Providers should make sure they understand the applicable Medicare Advantage reimbursement rules by reviewing the Terms & Conditions under the member's Blue Plan. Other than the applicable member cost sharing amounts, reimbursement is made directly by a Blue Cross Blue Shield Plan. In general, you may collect only the applicable cost sharing (e.g., co-payment) amounts from the member at the time of service, and may not otherwise charge or balance bill the member. BlueCard is a national program that enables Blue Cross and Blue Shield of Nebraska members to obtain in-network services while traveling or living in another state. The program links participating health care providers with Blue Plans across the country and internationally through a single electronic network for claims processing and reimbursement. This federal mandate applies to all individual policies, fully insured group health plans and both ERISA and non-ERISA self-funded groups, where the state law does not apply.

Coordination of benefits is the process used when a member has two health insurance plans. This process allows the two plans to work together getting you the most out of your coverage. The second plan becomes your secondary plan, which may pay toward the remaining cost, depending on the plan. Understanding which plan is your primary and which plan is your secondary is important to help prevent delays in claims processing. When you provide covered services to other BCBS MA out-of-area members', benefits will be based on the Medicare allowed amount.

Once you submit the claim, Highmark Blue Cross Blue Shield of Western New York will send you the payment. However, these services will be paid under the member's out-of-network benefits unless for urgent or emergency care. The Blue HPN EPO product includes an HPN in a suitcase logo on the ID card.

Members must obtain services from Blue HPN providers to receive full benefits. If you are a Blue HPN provider, you will be reimbursed for covered services in accordance with your Blue HPN contract with Highmark Blue Cross Blue Shield of Western New York. If you are not a Blue HPN provider, it's important to note that benefits for services incurred with non – Blue HPN providers are limited to emergent care within Blue HPN product areas, and to urgent and emergent care outside of Blue HPN product areas. For these limited benefits, if you are a PPO provider, you will be reimbursed according to Highmark Blue Cross Blue Shield of Western New York PPO provider contract, just like you are for other EPO products. The first percent, which is normally larger, shows how much the insurance company pays doctors and other health care providers who are considered "in network." "In network" means that the insurance company has an agreement with this group of providers. The second percent amount is the amount your insurance company pays doctors and other health care providers who are "out of network." Your insurance company does not have an agreement with providers who are outside the insurance company's network.

A health savings account is a tax-advantaged savings account that can be funded by individuals whose only health care coverage is a qualified high deductible health plan . An HSA is an alternative way for you to pay for your qualified health care expenses and save for future qualified health care expenses on a tax-free basis. Expenses such as out-of-pocket costs for office visits, prescription drugs, dental expenses and laboratory tests may be paid for from your HSA. A qualified health plan will have a certification by each Marketplace in which it is sold.

When you see any Blue members and you are aware that they might have other health insurance coverage give a copy of the questionnaire to them during their visit. Once the form is complete, send it to your local BCBS Plan as soon as possible. Your local BCBS Plan will work with the member's Plan to get the COB information updated. Collecting COB information from members before you file their claim eliminates the need to gather this information later, thereby reducing processing and payment delays. If you are not a Medicare Advantage PPO contracted provider, you may see Medicare Advantage members from other Blue Cross Blue Shield Plans but you are not required to do so.

For urgent or emergency care, you will be reimbursed at the in-network benefit level. The program links participating health care providers with the independent BCBS Plans across the country and in more than 200 countries and territories worldwide through a single electronic network for claims processing and reimbursement. The above-referenced claim thus was pended due to non-payment of premium, and will be denied if the premium is not paid by the end of the grace period.

The ACA mandates a three month grace period for individual members who receive a premium subsidy from the government and are delinquent in paying their portion of premiums. The grace period applies as long as the individual has previously paid at least one month's premium within the benefit year. The health insurance plan is only obligated to pay claims for services rendered during the first month of the grace period. The ACA clarifies that the health insurance plan may pend claims during the second and third months of the grace period. All states have health insurance marketplaces where consumers can compare health insurance product features, coverage, and costs.

Department of Health and Human Services has established a federally facilitated Marketplace, federally supported Marketplace, or a state-partnership Marketplace in the state. A Medicare Advantage HMO is a Medicare managed care option in which members typically receive a set of predetermined and prepaid services provided by a network of physicians and hospitals. Generally , medical services are only covered when provided by in-network providers. The level of benefits and the coverage rules may vary by Medicare Advantage plan. Members who have Consumer Directed Health Care plans often have healthcare debit cards that allow them to pay for out-of-pocket costs using funds from their Health Reimbursement Arrangement , Health Savings Account or Flexible Spending Account .

All three are types of tax favored accounts offered by the member's employer to pay for eligible expenses not covered by the health plan. Your health insurance company might pay for some or all the cost of prescription medicines. But not all cards have this symbol, even if your health insurance pays for prescriptions. Sometimes, the Rx symbol has dollar or percent amounts next to it, showing what you or your insurance company will pay for prescriptions.

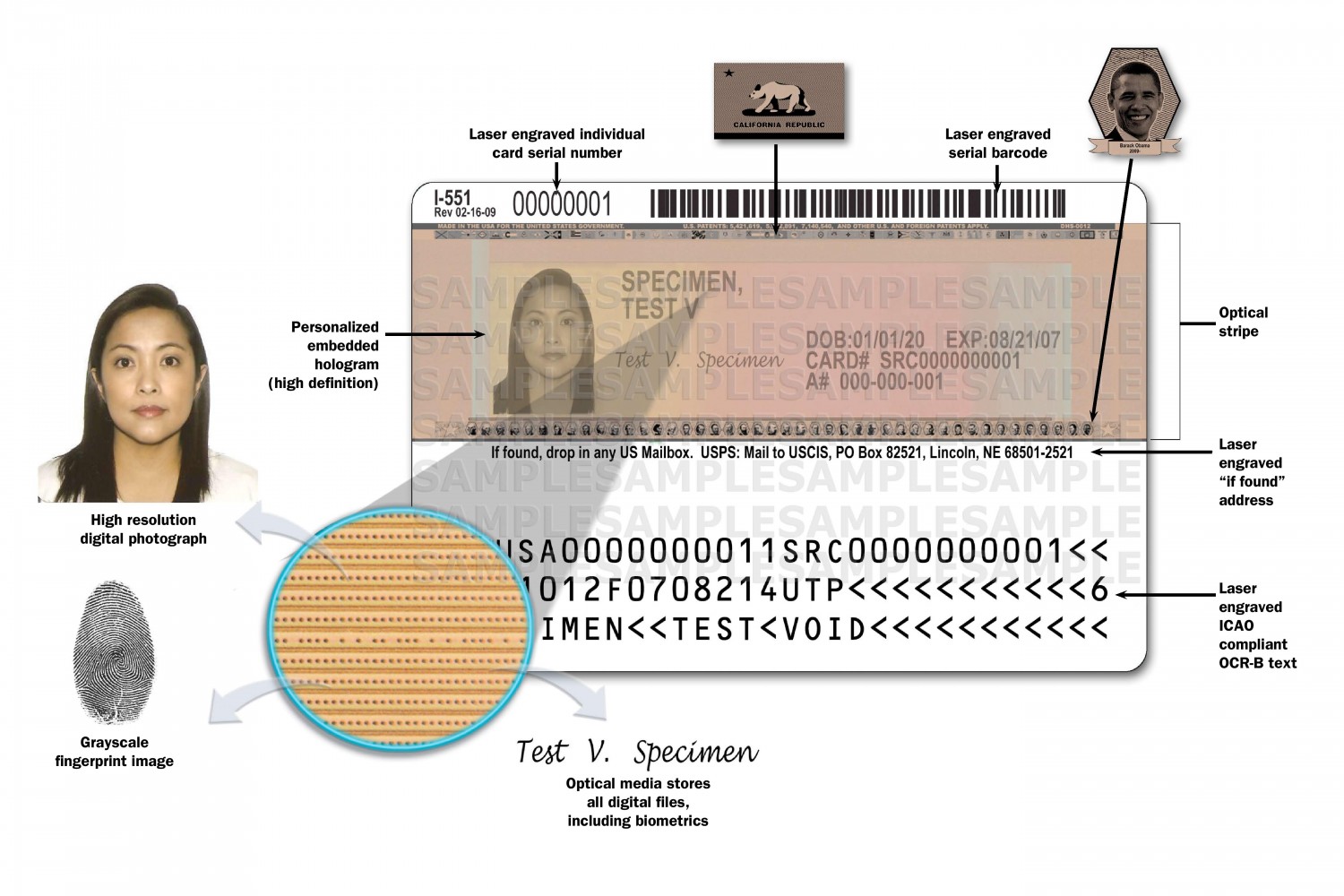

Cards show important health plan information, including the network the member may access, who is responsible for managing the member's care, where to submit claims, covered riders, and copayments. Diagrams in the "Sample ID Cards" section of this chapter show how to quickly locate key coverage details and contact information. Provides basic and/or supplemental hospital and medical/surgical benefits (e.g., basic, major medical and add-on riders) designed to cover various services. Such products generally include cost sharing features, such as deductibles, coinsurance or copayments.

An agreement with a health care provider not to bill the member for any difference between billed charges for covered services and the amount the health care provider has contractually agreed on with a BCBS Plan as full payment for these services. A health benefits program in which the member receives no benefits for care obtained outside the PPO network except emergency care and does not include a Primary Care Physician selection. EPO benefit coverage may be delivered via BlueCard PPO and is restricted to services provided by BlueCard PPO providers. When these logos are displayed on the front of a member's ID card, it indicates the coverage type the member has in his/her BCBS Plan service area or region. However, when the member receives services outside his/her BCBS Plan service area or region, provider reimbursement for covered services is based on the Medicare allowed amount, except for PPO network-sharing arrangements.

If you are a MA PPO contracted provider with Highmark Blue Cross Blue Shield of Western New York, benefits will be based on your contracted MA PPO rate for providing covered services to MA PPO members form any MA PPO Plan. Once you submit the MA claim, Highmark Blue Cross Blue Shield of Western New York will work with the other Plan to determine benefits and send you the payment. If you are not a contracted MA PPO provider with Blue Cross and Blue Shield of Western New York and you provide services for any Blue Cross Blue Shield Medicare Advantage members, you will receive the Medicare allowed amount for covered services. For urgent or emergency care, you will be reimbursed at the member's in-network benefit level.

Other services will be reimbursed at the out-of-network benefit level. After the member of another Blue Plan receives services from you, you should file the claim with Highmark Blue Cross Blue Shield of Western New York. We will work with the member's Plan to process the claim and the member's Plan will send an explanation of benefit or EOB to the member. We will send you an explanation of payment or the remittance advice and issue the payment to you under the terms of our contract with you and based on the members benefits and coverage.

The cards include a magnetic strip allowing providers to swipe the card to collect the member's cost-sharing amount (i.e., copayment). With healthcare debit cards, members can pay for copayments and other out-of-pocket expenses by swiping the card though any debit card swipe terminal. The funds will be deducted automatically from the member's appropriate HRA, HSA or FSA account. When you go to an appointment with your health care provider, they will ask you for your insurance information.

To find out if a provider is "in network" contact your insurance company. The "coverage amount" tells you how much of your treatment costs the insurance company will pay. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent. For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care. If you forget or aren't sure what type of health insurance plan you have , you can find out on your BCBS ID card.

If you have an HMO, your card may also list the physician or group you've selected for primary care. Determining whether a provider is in-network is an important part of choosing a primary care physician. Facilities are defined as a general acute hospital, satellite emergency department or ambulatory surgical center licensed pursuant to the Health Care Facility Licensure Act. Effective Jan. 1, 2021, providers in Nebraska may not balance bill patients for medical care received from out-of-network providers or facilities in emergency situations. This state mandate applies to all fully insured plans and non-ERISA groups.

Program designed to assist qualified small employers in facilitating the enrollment of their employees in qualified health plans offered in the small group market. The program allows employers to choose the level of coverage and offer choices among health insurance plans. SHOP insurance is generally available to employers with 1-50 employees, but in some states SHOP is available to employers with employees.

The Medicare Advantage Organization, rather than the Medicare program, pays for services rendered to such members. Members are responsible for cost-sharing, as specified in the plan, and balance billing may be permitted in limited instance where the provider is a network provider and the plan expressly allows for balance billing. The reference costs are established for an episode of care based on claims data received by Highmark Blue Cross Blue Shield of Western New York from providers in your area. Give the following article a thorough read to find out how to read a blue cross blue shield insurance card.

Members can login to myNebraskaBlue to access cost estimates and cost comparisons for a variety of treatments and services. By logging in, your benefits will be applied to the estimate so you can see costs based on your benefit plan (copay, deductible, coinsurance, etc.). ASO accounts are self-funded, where the local plan administers claims on behalf of the account, but does not fully underwrite the claims. ASO accounts may have benefit or claims processing requirements that may differ from non-ASO accounts. There may be specific requirements that affect; medical benefits, submission of medical records, Coordination of Benefits or timely filing limitations.

All Blue Cross Blue Shield Medicare Advantage PPO Plans participate in reciprocal network sharing. This network sharing allows all Blue Cross Blue Shield MA PPO members to obtain in-network benefits when traveling or living in the service area of any other Blue Cross Blue Shield MA PPO Plan as long as the member sees a contracted MA PPO provider. Medicare Advantage plans may allow in- and out-of-network benefits, depending on the type of product selected. Blue High Performance Network is a narrow network that is available to members that live in key metropolitan areas. Blue HPN members must access Blue HPN providers in order to receive full benefits.

If you are a Blue HPN provider, you will be reimbursed for services provided to Blue HPN members according to the Blue HPN contract with the Highmark Blue Cross Blue Shield of Western New York. After rendering services, the provider in Illinois files a claim locally with Blue Cross and Blue Shield of Illinois. Blue Cross and Blue Shield of Illinois forward the claim to Blue Cross Blue Shield of Tennessee that adjudicates the claim according to the member's benefits and the provider's arrangement with the Illinois Plan.

When the claim is finalized, the Tennessee Plan issues an explanation of benefit or EOB to the member, and the Illinois Plan issues the explanation of payment or remittance advice to its provider and pays the provider. The back or bottom of your health insurance card usually has contact information for the insurance company, such as a phone number, address, and website. This information is important when you need to check your benefits or get other information. For example, you might need to call to check your benefits for a certain treatment, send a letter to your insurance company, or find information on the website.

If you have health insurance through work, your insurance card probably has a group plan number. The insurance company uses this number to identify your employer's health insurance policy. On your card, it is often marked "Policy ID" or "Policy #." The insurance company uses this number to keep track of your medical bills. Getting a checkup now will help your PCP learn about your medical history before any health issues occur. You must use the BlueCross BlueShield of South Carolina card to receive medical or dental services, the Express Scripts card to fill prescriptions and the EyeMed card to receive vision care. Express Scripts is an independent company that contracts directly with the State Health Plan.

EyeMed is an independent company that contracts directly with the State Health Plan. It's your identification that says, "I am a Blue Cross NC member." The back of your card has several important phone numbers to use when you need help. You'll need to show it every time you visit an emergency room, urgent care center or health care provider. The out-of-pocket maximum is the amount each covered person must pay in a calendar year before your insurance covers at 100%. The out-of-pocket limit includes deductible, coinsurance and copayment amounts for medical and pharmacy services. The out-of-pocket limit does not include premium amounts over the allowable charge, charges for non-covered services, or penalties for failure to comply with certification requirements or as imposed under the Rx Nebraska Prescription Drug Program.

Out-of-network benefits are benefits provided by a provider who has not contracted with us to provide services as a part of the preferred provider organization in Nebraska. These benefits mean more out-of-pocket for members when services are incurred. SCHIP is a public program administered by the United States Department of Health and Human Services that provides matching funds to states for health insurance to families with children.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.